How to Calculate Home Loan Interest

Banks and NBFCs usually calculate home loan EMI (Equated Monthly Installment) using the Reducing Balance Method.

The formula is: EMI=P×R×(1+R)N(1+R)N−1EMI = \frac{P \times R \times (1+R)^N}{(1+R)^N – 1}EMI=(1+R)N−1P×R×(1+R)N

Where:

- P = Loan Amount (Principal)

- R = Monthly Interest Rate (Annual Rate ÷ 12 ÷ 100)

- N = Loan Tenure in Months

✅ Step 1: Convert Interest Rate

If your bank charges 8% per annum → Monthly interest = 8 ÷ 12 ÷ 100 = 0.0067

✅ Step 2: Example Calculation

- Loan Amount (P) = ₹40,00,000

- Interest Rate = 8% p.a.

- Tenure = 20 years = 240 months

EMI=40,00,000×0.0067×(1+0.0067)240(1+0.0067)240−1EMI = \frac{40,00,000 \times 0.0067 \times (1+0.0067)^{240}}{(1+0.0067)^{240} – 1}EMI=(1+0.0067)240−140,00,000×0.0067×(1+0.0067)240

👉 EMI ≈ ₹33,458 per month

✅ Step 3: Total Payment & Interest

- Total Paid = EMI × Tenure = ₹33,458 × 240 = ₹80,29,920

- Total Interest = Total Paid – Principal = ₹80,29,920 – ₹40,00,000 = ₹40,29,920

📌 Quick Tips to Reduce Home Loan Interest

- Choose shorter tenure (higher EMI, but less total interest).

- Make part-prepayments whenever possible.

- Compare interest rates before taking a loan (banks vs NBFCs).

- Opt for a floating rate loan if you expect interest rates to fall.

- Upcoming Real Estate Projects in Tirupati 2026 | New Launch Flats, Villas & Plots

- Tirupati’s Upcoming Ultra-Modern Bus Stand: ₹500 Crore Intermodal Bus Terminal Project Announced

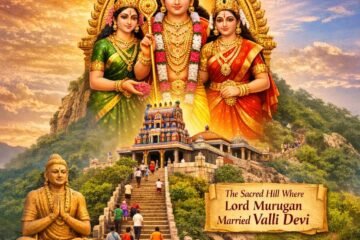

- Sri Valli Devasena Sametha Subramanya Swamy Devasthanam – Vallimalai

- IBO Stores Opening Soon in Tirupati – Two New Locations Announced

- Commercial Property Options via My Tolet India (Hyderabad)